As revealed by 30 for 30’s “Broke” and HBO’s new show Ballers, many professional athletes “go broke” after their playing days are over. They just don’t know what to do with all that money – and sometimes owning a car wash just isn’t a great investment. That’s why Jeff Fisher, head coach of the St. Louis Rams, requires mandatory financial counselling before his NFL draft picks are allowed to sign their contracts. And there’s an HR lesson to be learned from it.

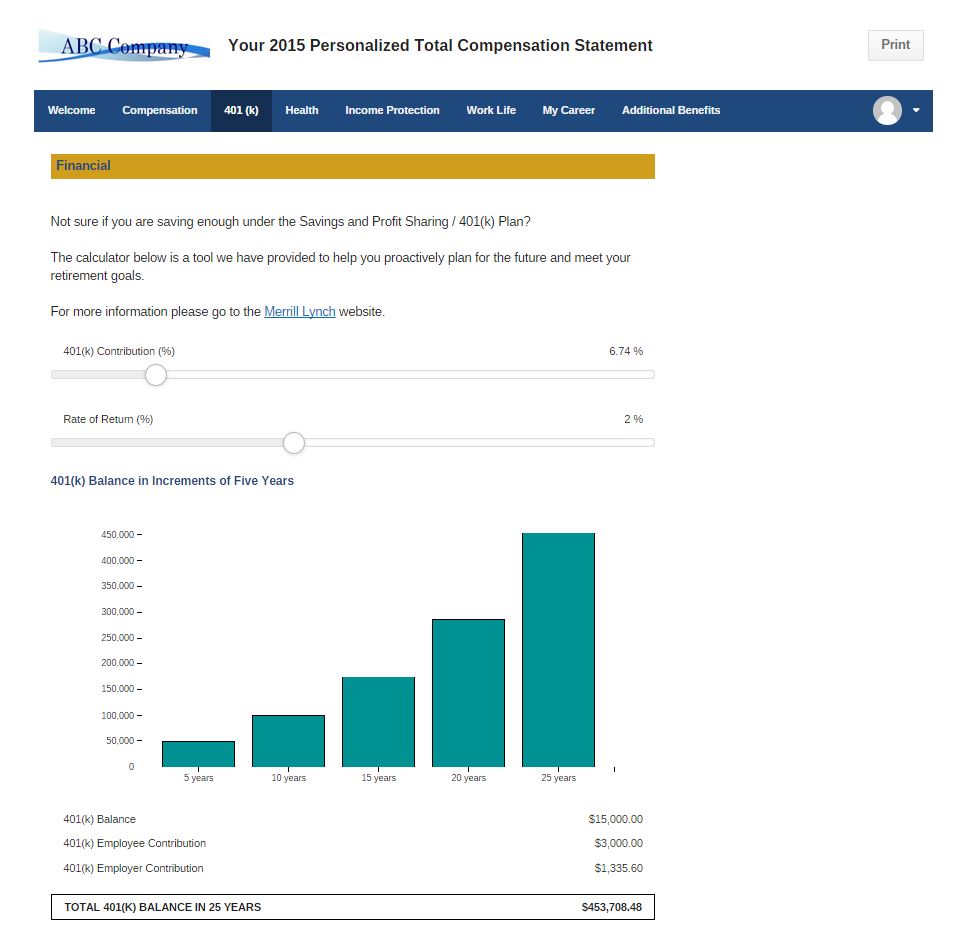

Today, competitive companies offer strong retirement and health care plans. But they’ll go to waste if employees don’t understand the benefits they’re receiving or how they’re a reflection of the way you value their services. Taking steps to explain the ins and outs of the 401ks and health care plans can make all the difference.

Your Position: Strong Savings

Like a rookie NFL player that’s trying to earn a spot in the league, it can be hard for young employees to care about retirement. Age 67 is just so far away, and they may not realize that $10 per month just doesn’t add up to a comfortable life after work. And if they don’t understand the options, they’ll never be able to put them to full use. Bring in a financial advisor to brief the team on the following items:

- Pre-tax and Roth 401(k)s

- The difference between a mutual fund and an index fund

- Targeted retirement funds

- Social security’s future

- The importance of saving early and often

- Employer match (and why your number is competitive)